How Market Sentiment And Trends Can Increase Crypto ROI

The crypto market is dynamic, so investors must stay ahead of the curve and use small yet critical details in their investment strategies. That’s why investors need to learn to understand market sentiment and trends. This article will take a closer look at how to analyze market sentiment and identify trends that will positively impact your return on investment (ROI) in the long term. Newcomers and existing crypto investors must gain insights into market sentiment and trends to make informed decisions.

Charting Tools for Market Sentiment and Trends

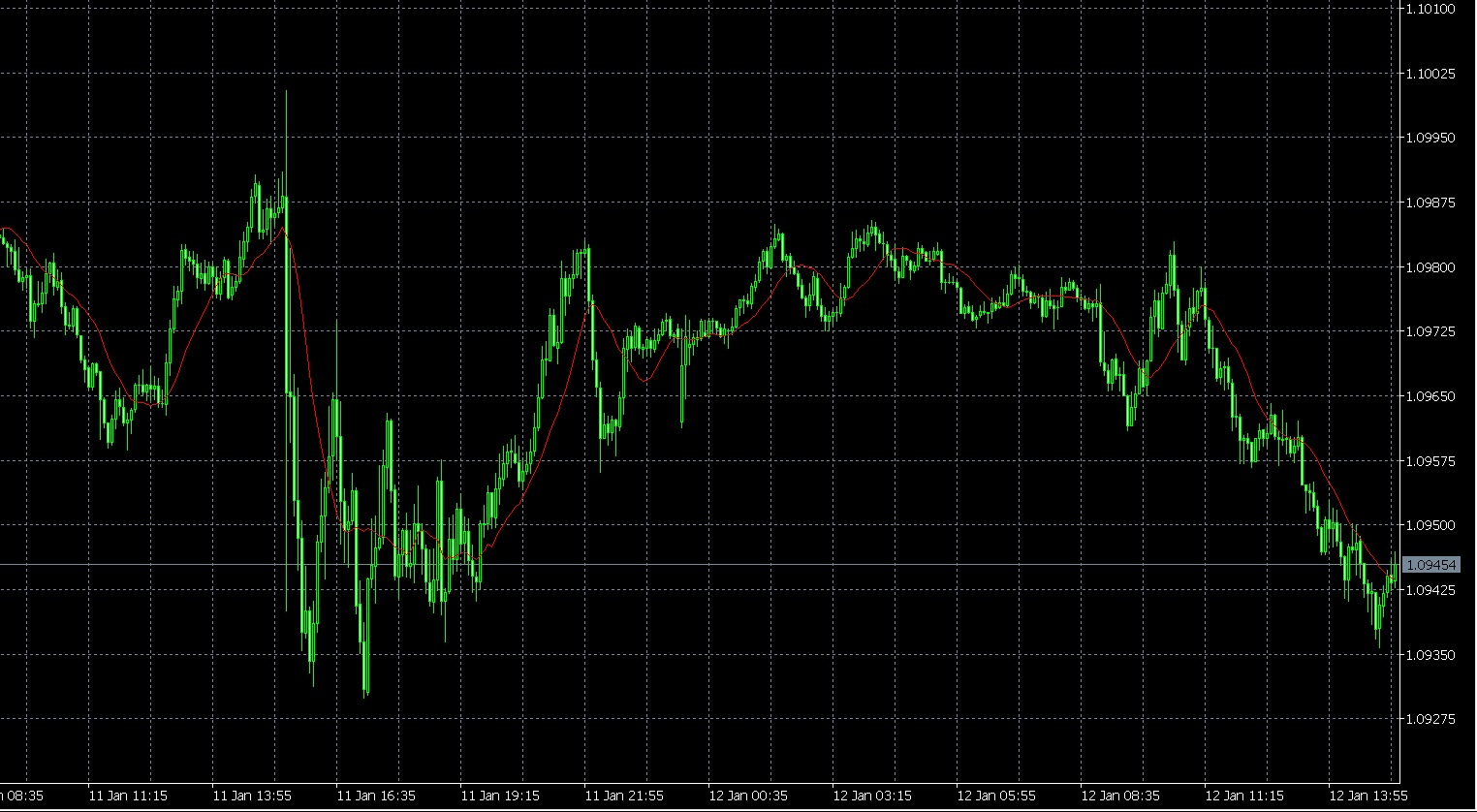

Charting tools can help understand crypto market trends. Charts are used for technical analysis, helping traders navigate various financial markets. It’s important to note that charts are the primary tool for investors, as they offer a visual representation of price action.

There are different kinds of charts that you can use to understand trends and price action in the crypto market. These include line charts, which use only one data point and are easy to understand, and bar charts, which contain more information like open, high, low, and closed data. Candlestick charts are also popular options, and they are one of the most popular charts since their depiction is pretty visual.

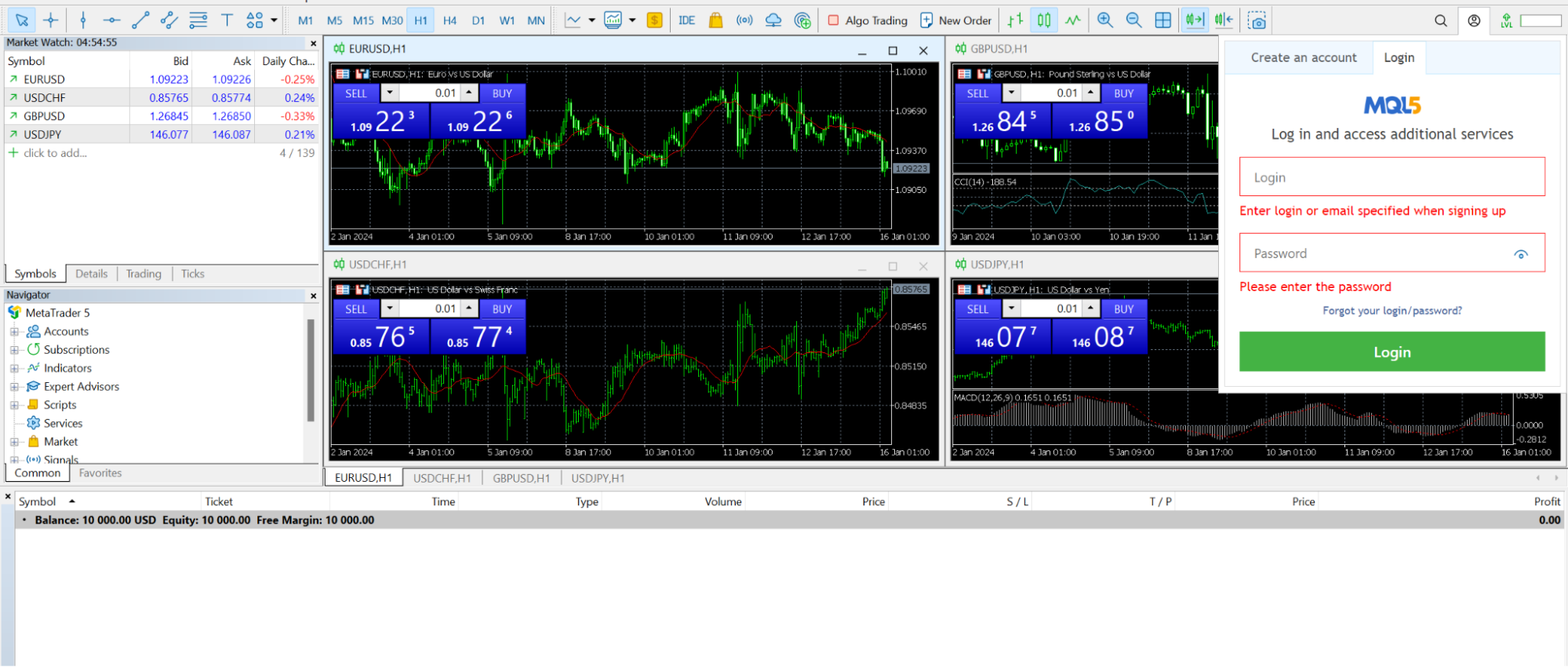

MetaTrader 5 is one of the most popular charting tools for traders to read price action and conduct practical technical analysis. Traders looking to trade a live account and access the full functionality of MT5 (MetaTrader 5) will need a broker.

MetaTrader 5, available on all major operating systems, is straightforward to use. Traders can open an MQL5 account on Meta Quote’s official website and enjoy access to over 16,500 advanced charting tools, indicators, and other services. For expert traders, you can multitask and view several charts simultaneously, which is excellent if you need to track price activity on various assets at once.

Metatrader 5, which allows you to view charts and stream live prices, offers different features to assist in trading, like technical indicators and professional analysis, which help identify trends. But it’s also a trading platform for stocks, forex, CFDs, and futures.

Understanding Crypto Market Sentiment

Market sentiment is defined as the attitude of investors regarding the financial market, a company, a sector, or an industry. The sentiment of investors is reflected in the buying and selling activity. Generally, falling prices in the crypto market reflect bearish market sentiment, while increasing prices indicate bullish market sentiment.

Day traders and those in technical analysis need to understand market sentiment. There are different benefits to carrying out a market sentiment analysis, starting with the fact that it gives a better understanding of the short-term and medium-term price movements. It also helps you identify profitable price trends.

Before you take a cryptocurrency trade, you should use all the available information, including market sentiment. This will help you decide whether getting ‘FOMO’ on a trade is rooted in a solid reason or merely a whim.

Gathering different views, ideas, and opinions is crucial to performing crypto market sentiment analysis. It’s vital to join social media platforms like Telegram channels, Discord servers, Reddit discussions, and official project forums and use data collection tools to track mentions. Also, stay updated on industry news from reliable sources like CoinDesk and CoinTelegraph.

It’s also essential to monitor the significant cryptocurrency holders’ activity — known as whale activity. There are market sentiment indicators that you can use to understand the overall sentiment of the crypto market. Google Trends is also an excellent way to check the level of excitement around a project.

Identifying Trends in the Crypto Industry

You don’t only focus on market sentiment when trying to increase crypto ROI. Identifying trends and using them to make informed decisions in the crypto market is also essential. The market is always moving in three main trends: up in an uptrend, down in a downtrend, or sideways in a consolidation or channel.

There are different ways to identify trends, usually available as charting tools and patterns. These include trend lines, moving averages, bullish or bearish flag patterns, indicators, the Bitcoin dominance ratio, and double-bottom cryptographic patterns.

The upward trend is easily identified because the prices reach higher highs and higher lows.

These trends are easily plotted in a chart with an uptrend line. The moving average can be used to identify the trend. Then, there is the downward trend, which happens when prices experience lower lows and lower highs. Sometimes, during an uptrend or downtrend, the market moves sideways. These are consolidated trends that occur during dull markets.

Tips To Navigate the Crypto Market

Before investing your hard-earned money in the crypto market, you should understand how trends and sentiment work using tools and research.

Here are some tips to help you understand the market:

- Keep up with the current market conditions using reputable websites and real-time data.

- Follow top investors and leaders in the space for better investment confidence.

- Fully understand the factors that cause prices to rise and fall.

- Diversify your portfolio and consider investing in non-crypto spheres.

- Understand the relationship between circulating supply and market capitalization.

- Carry out detailed research on individual coins and tokens before you invest.

- Be prepared for volatility.

Generally, data analysis is fundamental in trading. As trading is fast-paced, making informed decisions is pivotal for a successful ROI. Data analysis gives complete insight into market trends, investor sentiment, and price movements in the market. By becoming an informed investor on the trends and sentiments in the crypto market, you can always stay ahead of the curve, be prepared for market shifts, and increase the ROI.

What's Your Reaction?

Deepak is a lover of nature and all things sporty. He loves to spend time outdoors, surrounded by the beauty of the natural world. Whether he's hiking, biking, or camping, Deepak enjoys being active and in touch with nature. He also loves to compete and push himself to his limits. Deepak is an avid cyclist, runner, and swimmer. He has competed in several triathlons and marathons, and is always looking for new challenges to take on.