Explain the Differences Between Purchasing and Leasing a Car for Business

Differences Between Car Leasing and Car Buying

Vehicles are an entity’s long-term assets used to conduct daily company operations. There are two ways you can use automobiles like cars, vans, or pickup trucks. Leasing a car allows one to use it for a predetermined amount of time while still owning it. Simply put, buying a car means paying for it upfront or over time in installments.

Leasing, on the other hand, is a little different since it enables you to utilize the item for a predetermined amount of time in exchange for regular lease payments. Therefore, you must take into account certain factors related to your needs, use, duration, and other factors before making any decisions. To achieve this, you must first understand the distinction between renting and purchasing.

Leasing: What Is It?

Leasing is similar to hiring a car out for a while. You only have to pay the amount of depreciation that is anticipated to occur over the course of the lease, plus interest and any other fees, as opposed to the full purchase price, as you would if you were purchasing the vehicle.

Most car leases are closed-end leases, meaning that the final residual value is fixed before you even leave the dealership. You can use your bank card for leasing or start using it after reading the ll bean credit card review for your benefit.

For a leased automobile, you typically, but not always, need to put down some money. The remaining leasing amount is divided into a number of equal interest-inclusive monthly installments. Although a lease agreement can be made for nearly any duration, the typical lease periods are for two or three years.

Although the idea of leasing seems straightforward, obtaining a lease is a complicated financial transaction that uses terminology that is distinct from that of automobile purchases.

The Meaning of Buying

A purchase is an agreement whereby the seller gives the buyer ownership of the Car in return for a sufficient monetary payment. Along with the transfer of title, the risk and benefits associated with ownership are also passed.

The buyer can either pay the whole amount up front, in one lump sum, to take ownership of the asset, or they can put a down payment on the item in exchange for a promise to pay the remaining balance in recurring monthly installments. The cash price or down payment, taxes, registration fee, and other fees make up the upfront cost.

There are no limitations on the asset’s usage, transfer, or sale because the buyer owns it. Additionally, he is required to cover the expense of repairs and upkeep.

Tax Advantages

When a small firm uses a particular vehicle for commercial activities, it enjoys significant tax benefits. Deductions for an owned automobile include depreciation, a set rate, and actual expenditures. Standard rate or real cost may be used as an expense for a leased automobile, but not both.

- Depreciation is the amount that you may write off over the course of a vehicle’s life to reflect a loss in value. Because of wear and tear and mileage accumulation, an automobile loses value over time and can be written off as a deduction. You may lease a wide range of vehicles and fuel kinds for your organization with GSA Fleet.

- Standard rate: For the duration of the lease, a business owner may write off business miles traveled at the IRS-established standard mileage rate utilizing the standard rate technique. The first year the automobile is offered to your company must be the starting year for this. For the first half of 2022, the normal mileage rate was 58.5 cents per mile, and for the following six months of 2022, it was 62.5 cents per mile.

- Actual cost: The expenditures related to operating a car, including petrol, oil, maintenance, and depreciation or lease payments, can be written off using the actual cost technique.

How to Choose Whether to Purchase a Car Outright or Lease One

Whether renting or purchasing is the best choice for you really depends on your situation. You should provide your own responses to a few questions in order to make the best choice possible.

How many Kilometers Are You Planning to Put in the Car?

You need to be aware of how far and how many miles you’ll be driving the vehicle. The typical annual mileage cap for leases is 12,000 miles. This means that the Car must be at that price or less when you return it. At the end of a three-year lease, the vehicle will have traveled 36,000 miles.

What Kind of Down Payment Do You Have?

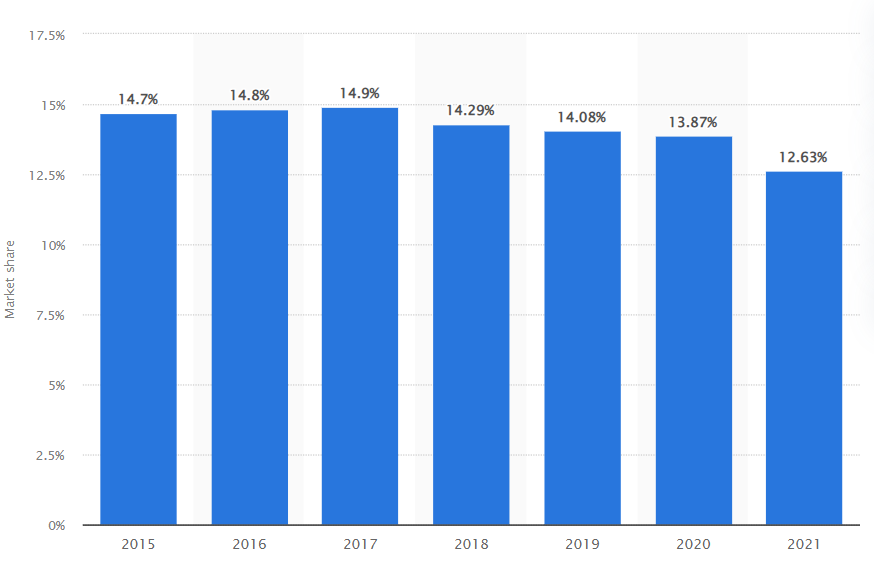

Knowing how much money you have available for a down payment is another factor to take into account when deciding whether or not to lease. When you enter a lease agreement for a car, you often have less money to deposit. Some leases don’t demand a deposit when you lease the vehicle. Your monthly payment will be higher the less money you have for a down payment. It is interesting that Ford’s market share in the United States in 2021 was at 12.6%, placing it behind General Motors and Toyota Motor.

How Will You Operate the Car?

When utilizing a rented car for work, the leasing company may set restrictions on the times and methods of use. The regions in which you can drive can be limited. Although you might not need a car to get to such places, you should be aware of this before signing a lease. Make sure your rented Car may be used for work purposes as well. You should make sure you may utilize your lease in this manner if you want to use your Car for a service like Uber.

Conclusion

If you want cheaper monthly payments, desire a new automobile with new technology every few years, and don’t want to bother about some responsibilities, like selling your Car, leasing might be appealing. You might not ordinarily be able to afford a premium vehicle, but leasing can let you get one.

When you purchase a car, you either get ownership of it entirely if you pay cash or you accrue equity when you settle a car loan. You’ll be in complete control of your costs and able to service or repair them as necessary. You’ll be able to drive as frequently as you’d want, customize your vehicle, and get rid of it in any way you see fit.

What's Your Reaction?

Deepak is a lover of nature and all things sporty. He loves to spend time outdoors, surrounded by the beauty of the natural world. Whether he's hiking, biking, or camping, Deepak enjoys being active and in touch with nature. He also loves to compete and push himself to his limits. Deepak is an avid cyclist, runner, and swimmer. He has competed in several triathlons and marathons, and is always looking for new challenges to take on.